A woman who is conscious about spending and making money has made the decision to be aware of her finances and uses tools like budgeting to her advantage. She typically educates herself about money saving methods such as paying off debt, spending wisely, becoming more frugal, and reducing bills. These money conscious women also spend a great deal of time learning how to increase their income through learning to invest, improving their credentials and bettering themselves, and creating passive income or side income. They do all of this while living a good life and enjoying the fruits of their labor. Here are 11 habits we can learn from women who always have money.

They are not wasteful spenders:

These women are conscious buyers. They don’t go rushing out to buy items. Instead, they think before they buy. They take the time to comparison shop, and in turn, don’t spend as much on groceries, bills, and even bigger items like cars. This type of conscious spending keeps them from going deep into debt. They understand that debt actually keeps their money from working in their favor.

They budget in for fun and only buy what they can afford:

Women who use a budget not only know how much money they make, they have a clearly defined budget for what they want to buy. They mostly buy items that are useful, but they also save up and budget for things that make them happy. They run their numbers and stick to spending only what they can afford, especially on big items like rent or a mortgage and car payments. Head to this post to get our free ABC Budget Worksheet and use it to declutter your spending.

They mostly eat at home and cook their own healthy meals:

Eating out can cost you up to three times what it would cost you to make your meal at home! This means a $15 meal could be made for $5 at home. Did you know that simply cooking vegetables is actually a great way to save money? Cooking meals at home can be a win-win because it helps you save money by keeping you from overspending at restaurants AND you can choose to eat foods with a higher nutritional value.

Women who always have money don’t typically pay interest on credit cards:

Money-conscious women usually don’t carry a balance and pay interest on their credit cards. They use points cards or cashback cards and pay off their credit cards each month. This means they actually get paid to use their credit card! Pretty cool, right! They also have a real handle on using their credit cards. They think before purchases and don’t carelessly spend with a card. Check out this article for tips about paying off your credit cards.

They look for ways to cut out bills or reduce spending:

They track their spending monthly and always look for ways to cut out overspending. They are conscious about their bills and decide whether they need to keep paying for something monthly or not. You can save thousands of dollars a year when you cut out unnecessary spending and become more frugal. Read this post to learn ways you can instantly start reducing expenses.

They find fun ways to work out and entertain themselves for free:

These women love to spend time in nature, at the park, or doing things that keep them fit and happy while not breaking their budget. They find ways to stay in shape for little to no money, or they find ways to make extra money while keeping fit!

They pay themselves first and ALWAYS SAVE:

They know their priorities when it comes to money and one of their BEST money habits is they pay themselves first out of every paycheck. They ALWAYS save a quarter to a third of their income before paying any bills or spending any money. They don’t joke around about this. Saving is one of their biggest values.

They educate themselves about money:

Money-conscious women don’t make excuses that it’s too hard to learn about investing or that they don’t like looking at spreadsheets for budgeting. They overcome their limiting beliefs when it comes to what they can learn, and they take real actions after reading books, taking courses, and speaking with experts. They apply their new knowledge and build upon what they learn so they see real growth not only in themselves but in their savings and investments.

They are not scared to charge more or ask for a raise:

They have done the inner work when it comes to charging more or making more income. While they may still have fears, like anyone else, they don’t let their fears get in the way when it comes to charging what they are worth or asking for a raise or a promotion.

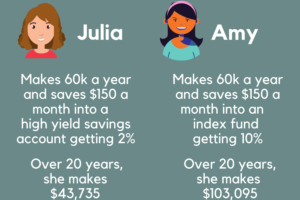

They invest wisely and often:

Women who always have more money often learn to invest at an early age in life. They make their money work for them and find ways to create many income streams so their money is diversified. They might be investing in a 401K or Roth IRA, and they understand what it means to let their money compound. They typically find ways to create multiple incomes or ways for their money to grow, such as investing in real estate, side businesses, or creating passive or interest income.

If you have been wanting to learn how to make more passive income through investing, click here to learn more about our Investing course.

They don’t stress about money:

They discover ways to get out of the rat race and stop stressing about living paycheck to paycheck. They take charge of their money and stick to their budget and financial plan. Because of this, they are happier and more empowered about their money. They know where their money is coming and going, and they don’t feel a sense of lack or constant fear around money.

Having more money in the bank can happen if you apply these habits for yourself. It all starts with sitting down and addressing the most important things first with your finances. When you do this, you start to work towards a feeling of relief about money. It may not be so much fun in the beginning. Doing things like budgeting and working through difficult situations surrounding your credit might be scary, but once you do it, and create a money routine, you will start to feel more empowered and more at ease!

Applying these money saving and money making habits a little each day is the key. Choose just one or two and see how it shifts your life for the better! Let us know how it goes!

Join our exclusive email list for Money Saving and Money Making Hacks!

You’ll receive some of our best tips and hacks we have for making and saving money.

So whether you want to increase your income, get out of debt, or learn to invest, we’ve got you covered!

Leave a Reply

Your email is safe with us.