I’m going to share with you my plan to reach financial independence at an early age. These are the things that I learned with time and WISH someone would have shared them with me in my early twenties.

I am lucky enough to have a dad who is wise with money, and some of the foundational things I am going to share here are things he taught me.

Other money lessons came with experience and trying things and noticing what works and what doesn’t. Many financial tips came from pouring through books about investing, business, budgeting, and retirement.

I understand that some of these tips may not apply to you, but I feel like many of the things I am sharing here are things that pretty much everyone can do. They are simple and yet most people just never learn them, which is so sad to me.

This is why I love sharing what I’ve learned through the years!

Reaching financial independence at an early age is entirely possible!

I accomplished financial independence by the age of 37. As of this writing, I am 45, and I write, blog, coach and teach because I LOVE TO.

If you are wanting to reach financial independence at an early age, it’s simply a matter of getting educated and then applying the tips as soon as possible.

I’m going to share the steps I took and also reveal the age I discovered the tip and when I actually applied it. Looking back now, I sometimes smack my forehead and say, “If only I had applied that tip sooner.” But I don’t want this to be the case for you. Hopefully you read this article and it changes your life NOW.

I will also say that some of these tips are things you might feel resistance about. I have coached a few people out of debt and into financial independence. In the beginning stages, many people took awhile to apply the principles. But once they did, and they saw results within a year, they became more excited and started applying more of the principles. Getting started is always the toughest part, but I will make a few suggestions at the end of the post for how to start simply.

Key factors I took for reaching financial independence at an early age

1. Knowing your income and expenses

Okay I have to say that NO ONE really showed me how to look at my budget. It wasn’t until I was twenty-one years old, in college, maxing out my credit cards and getting deeper into debt that I finally looked at my whole financial picture. I didn’t know where money was coming or going. Relying on credit cards as income became second nature to me which is a HUGE no, no. And I was making minimum payments on my credit cards, which is another HUGE no, no. It’s safe to say that I could have easily ended up in a really bad situation. But my money nerves got the best of me. I was so anxious about the increasing numbers on my credit cards that I finally thought, “Hmmm, maybe I should just sit down with all my bills and really map out my finances.”

Thank God I did!

Knowing your expenses and income helps you to see your flow of money. It also provides you with information about whether you need to cut back, make more or be saving more.

In that sitting, I immediately saw that I had a major problem managing my credit cards. I realized I had no business using them! Not understanding how to pay off the monthly balance was getting me further into debt. I just thought the money would keep coming out of them. Well, at some point, you reach the limits, and the card companies start asking for their money.

I even tried to play the game of moving money from one card to another. Ughhh! These tactics just don’t work.

One of the top keys to reaching financial independence is to know your expenses and income. Create a budget now if you don’t already have one. It will be EYE-OPENING!

Related article: Tracking Income Suddenly Made My Income Increase

2. Saving at a higher rate

This tip came to me when I was in my late twenties from my dad. He was in his fifties at the time, and he kept telling me how much he regretted not saving sooner. Luckily, he repeated it so often, at some point it sank in for me.

My dad realized if he had simply saved just 20% of his income starting in his twenties, he would have been a millionaire by fifty years old! He sat me down one day and showed me this calculation, and he said to me very simply, “Just max out your savings NOW.”

I got the picture really quickly, and I am so grateful for that money lesson. It actually inspired me to sit down with him more often so he could share money wisdom with me all the time.

If you simply save aggressively now, it will allow the money to compound earlier. I will explain compounding later in the article. Just trust me on this… save 30%, 40% or even 50% of what you are making if you can.

Of all the people I know, the ones who saved 40% or more of their income ended up retiring early, and they did so with plenty of income-producing assets.

Because of this information, I started saving 50% of my income in my highest income-producing years, which were in my thirties. And this is the biggest contributing factor to why I reached financial independence at an early age.

Related Article: How Much Money Should I Save?

3. Live frugally

Luckily, living frugally was something instilled in me as a child. Actually, my mom sometimes teases my dad because he is so careful with his money. He’s been known to call a company when he sees a billing error of a dollar.

Living frugally has always been a part of my life, and I’m grateful I learned it at an early age. Basically, my parents told us they would buy us books or anything related to education. Anything else we desired would have to come from our own money earned or saved.

Living frugally also taught me the value in cherishing a night out to eat. We only ate out maybe twice a month as kids.

Frugal living has been one of the key reasons I have been able to reach financial independence at an early age. I don’t long for material things, I don’t need fancy dinners, and I enjoy living clutter free!

Once you get your budget laid out, this will provide you with a snapshot of your monthly spending. Simply ask yourself where you can start to become more frugal.

Perhaps you can cut back on cable… Here’s a great example of how saving just $85 a month on your cable bill can make a huge difference in your early retirement plans:

That $85 a month multiplied by 12, turns into $1,020 per year. When you invest that $1,020 in a low-fee index fund and get a 7% return (which is considered pretty average), that same $1,020 invested for over 30 years turns into $96,350.00. This is the compounding power of living frugally and investing early. If you’d like to try this out on your own, click here for a nifty calculator from the Securities and Exchange Commission.

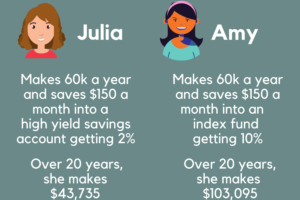

4. Investing the extra money in index funds with low fees

Once you start cutting back your expenses from living more frugally, you will have extra money left over at the end of the month! Woo hoo!

This is the perfect time to apply the principle of “pay-yourself-first” and have the extra money automatically deposited into a brokerage account.

One of the BEST THINGS I EVER DID for my financial future was starting an account at Vanguard. I opened that account around the age of twenty-six years old.

The earlier you can open an account and start sending over money, the better. The reason for this is compound interest. This is basically the interest calculated on the initial amount of money you deposit and also on the accumulated interest of previous periods of a deposit. Essentially, your money grows faster because of compound interest. For those of you who are really wanting to nerd out on this, you can use the same calculator with the Securities and Exchange Commission to see what compounding will do to your investment account.

Make sure to open an account with a brokerage who carries a collection of index funds with low fees as well. There are many to choose from at either Vanguard or Fidelity. We go over how to start and open a brokerage account and invest in an index fund in one of our most popular posts. You can read the article by clicking here. Investing is something you can start while you are paying down your debt. In fact, I suggest you get started as early as possible so you can take advantage of compounding and instill good habits of saving automatically NOW.

The key here is to move as much of that extra money over to your account each month as you can, and then don’t touch it! Assess your account performance once every six months. As long as the trend is generally up over a five year period, stay the course. Of course some funds perform better than others, so take a look at a popular selection, and then choose one or two to start. For more tips about investing, read my favorite book by Peter Mallouk, The Five Mistakes Every Investor Makes and How to Avoid Them.

How to start your plan to reach financial independence at an early age

Here are a few questions to ask yourself to help you get started with creating your own plan for reaching financial independence at an early age.

- First of all, what is your goal or dream? Do you want to live a more simple life in the country? Do you want to travel by RV, by boat, or vacation abroad? Determine these goals first to give you an idea of the amount you are aiming for. Everyone’s number will be different.

- Determine when you want this to happen.

- Ask yourself if your budget can be tightened in any way to help you put away more money now. In what areas can you live more frugally? How can you get your family on-board and make it a goal?

- How much can you send away per month to your brokerage account? If getting started with sending off money seems impossible, start with a small amount like $100. Everyone I coach has a hard time getting started. They THINK they need that extra $100 a month. Trust me, if it comes out of your account automatically once a month, you will have more success. Once a few months go by, and you see that investing $100 is easy to achieve, then it’s time to bump up the amount. Try to go up to $250. Then move it up to $500. And keep challenging yourself to move up the amount each month.

Leave a Reply

Your email is safe with us.