I went from being in debt with school loans to building a business and portfolio of over $1 million dollars. Here’s how I took my power back with my finances.

One of the hardest AND yet eye-opening aspects of money management is sitting down to assess what is realllllly going on with YOU and your money.

What I discovered about myself when I did this was I had a real spending problem with my credit cards. At the same time, I had student loans piling up, AND I was on track to eventually work a 9–5 job making under $50k a year.

When I started becoming more aware of my financial issues, I discovered I was not living what I really wanted for myself: to be free of debt, to have money invested and working for me, and to retire from my job so I could focus on my passions and traveling.

These realizations helped me decide to learn more.

As I considered my real goal of retiring early, and I allowed myself to see this as a possibility, suddenly I was able to create a plan.

I read a few great books about personal finance and investing. I also spoke with personal finance experts and found out there were simple actions I could take to set myself in the right direction… (We never know if we are going to accomplish that thing we are setting our sights on, but if we at least try, we might come close… OR we might get something even better!!!)

I discovered there were people just like me

So in this discovery process, I found out there were people like me! They were part of what’s called the F.I.R.E. movement, and there are specific things they have figured out you can do to retire early!!! Woohoo!

Suddenly, I started to see that this pie-in-the-sky hope and dream could actually become real because others were already doing it.

FIRE stands for Financial Independence Retire Early. You can accomplish it when you do things like…

Live below your means

Track spending

Create multiple streams of income

Invest early and often

Just doing a few of these can make it possible for you to retire earlier in life or have enough saved to do passion work (which doesn’t feel like work at all).

My personal wake up call with my finances

My personal wake-up call came when I sat down to look at my finances, and my credit cards and student loans added up to more than $40,000!

At the time, I had no idea how credit cards worked. I didn’t understand how paying the minimum balance was getting me further into debt because the interest rate was so high.

Paying for things without tracking my spending and income was keeping me blind to my financial picture. I also didn’t realize how quickly I was accumulating debt because I wasn’t making enough from my part-time job to cover my expenses.

At some point, I decided to put my credit cards in bags of water. I literally froze them so I could break my habit of always using them without considering the cost of my actions. Head here to read how freezing my credit cards changed my financial life!

I had to get real about my finances

It wasn’t until I got real about my spending habits and lack of financial education that I started to see how my actions were setting me up for failure from the start.

And sadly, I know I wasn’t alone in lacking financial sense or education.

At last check, according to Educationdata.org, 65% of graduating students enter the working world with student debt!

This is why I share these messy and real parts of me… Because I know there are people out there who also feel very overwhelmed but want to be more financially empowered so they can create a life they love. They want to have more freedom and do work that lights them up. But they struggle with feeling scared about their future and don’t know where to start.

Related articles to get started:

Achieve Financial Independence with Be Passionate and Prosper

ABC Budget Worksheet- Use it to declutter your spending

Paying Yourself First- How to Trick Yourself Into Saving Money Fast

Taking your power back with your finances starts with aligning with a life you want

I know you can have an amazing life. It starts with accepting where you are and making conscious decisions to make changes in your life that align with the life you want for yourself.

You must also realize that you can create money at any time. You don’t have to wait until you graduate from college to start creating wealth. I started a side business while going to college, and it grew so quickly that by the time I graduated, I was making more than I could with a degree.

Within a few years, I was making six figures, and within 7 years I was making multiple six figures. My ability to create more money shifted when my beliefs around money shifted. As I came to expect that I could make more money, I made more… to the tune of 7 figures eventually.

Instead of worrying about where my next dollar would come from, I focused on how to make my money grow and work for me. I learned to invest in the stock market and real estate and eventually built my portfolio up to over $1 million.

This all happened because I sat down and asked myself what kind of life I really wanted. I got real about how I was showing up and dealing with my finances. If I had never done that, I would have never made a positive change or reached my goals.

Here are some things you can ask yourself to see if you are living in alignment with the best version of you (financially speaking)…

Questions to ask:

- Am I looking at my financial picture with the aim to understand my numbers? Am I tracking spending and income, working down debts, and living within my means)?

- What are my beliefs surrounding money? Do I believe I’m capable and worthy of having more money or making more money? If not, why? What story is holding me back?

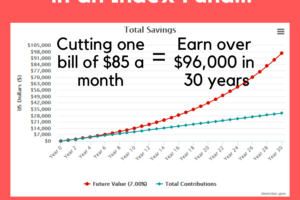

- Am I paying myself first and sending money each month to investments in alignment with my goals? How much could I start with, $25, $50, $100 a month, or more?

- Am I allowing myself to evolve or promote, either by asking for a raise from my employer or by expanding my business? What is a way I could earn more?

- Am I willing to change bad habits and negative beliefs when it comes to finances? What’s one bad habit or belief I could address this month?

- Am I educating myself about personal finance, either thru books or mentors? If not, what would be one way or a topic I could start with?

Sign up for our FREE 7 Day Master Your Money Course. This free course provides you with worksheets to get your finances back on track and help you grow your money. You can sign up by clicking here!

Leave a Reply

Your email is safe with us.